| 作者 |

[转帖] 授人以渔-TA(2) [转帖] 授人以渔-TA(2) |

|

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

作者:theoretical 在 谈股论金 发贴, 来自【海归网】 http://www.haiguinet.com

In this specific case, I feel the urgency to talk about credit market first. And I will finish the rest later.

How to gauge the credit market?

1, TED spread

2, Credit default swap rate

3, Commerical paper rate

1. TED spread

One measure being commonly used to summarize the strain in financial markets is TED spread.

This is calculated as the gap between 3-month LIBOR rate (an average of interest rates offered in the London interbank market for 3-month dollar-denominated loans) and the 3-month Treasury bill rate.

What is reading now? 3.87, wowo.

Okay, then why would a bank want to borrow overnight dollars for 4-5% in London when it could be assured of obtaining those same funds for 2% later that day in New York?

For one thing, the situation was sufficiently chaotic two weeks ago that many banks in fact were unable to borrow in New York at 2%. The effective fed funds rate (a volume-weighted average of all the known U.S. trades on a given day) was 2.64% on Sept 15 and 2.80% on Sept 17, despite the Fed's intention to keep these numbers around 2.0. Somebody who was worried about how these days were going to unfold may have quite rationally bid quite a bit to secure the funds early. Or perhaps the U.S. banks dropped out of the London market altogether.

In any case, a one- or two-day spike in this overnight rate is not that big a deal, since even a few hundred basis points (at an annual rate) is not that much money on a one-day loan.

However a longtime over300 point spread will definitely crash the market. So if I am right, something will be done very soon unless Fed and treasury would like to watch the waterfall on the sideline.

Can Fed do anything about it? The answer is yes.

The Fed could simply lower its target for the fed funds rate, and chase the T-bill rate down to zero, if it wanted

2, Credit default swap rate

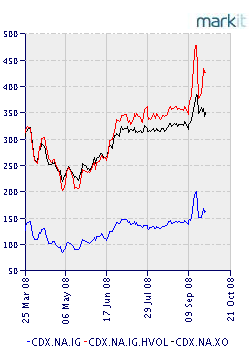

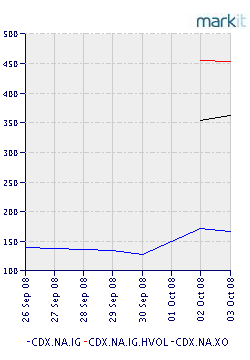

There are currently two main CDS indices: CDX (US and Canada) and iTraxx (the rest of the world).

We know credit default swap is OTC trade, CDS index is just a way to provide liquidity to the market and therefore trade at smaller bid-offer spread.

Okay, so what is its indication about credit market?

If credit market tightens, the rate jumps higher, that means, you have to pay more to hedge your portfolio of CDO CDS or bonds

From the charts, you can tell it is still pretty high, suggesting a tighting market.

3, Commercial paper market

Commercial paper is a type of short-term debt bought by money market funds, many of which have suffered losses on Lehman Brothers debt after it filed for bankruptcy over two weeks ago.

As a result, billions of dollars have been withdrawn from the funds, with investors losing confidence in the credit markets and instead opting to place money in safe investments such as short-term US Treasury debt.

5 days ago, S&P just started a index to measure commercial paper market

https://www2.standardandpoors.com/portal/site/sp/en/us/page.topic/indices_uscommppr/2,3,3,0,0,0,0,0,0,1,1,0,0,0,0,0.html

作者:theoretical 在 谈股论金 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

|

-

[转帖] 授人以渔-TA(2) -- theoretical - (3410 Byte) 2008-10-09 周四, 10:21 (2692 reads) [转帖] 授人以渔-TA(2) -- theoretical - (3410 Byte) 2008-10-09 周四, 10:21 (2692 reads) - 顶!谢谢! -- 夏日 - (0 Byte) 2008-10-09 周四, 17:38 (289 reads)

|

|

|

|

您不能在本论坛发表新主题, 不能回复主题, 不能编辑自己的文章, 不能删除自己的文章, 不能发表投票, 您 不可以 发表活动帖子在本论坛, 不能添加附件可以下载文件, |

|

|